Articles

Easy immediate access to your profile thanks to on the internet banking, the new RBC Mobile Application and you will thru cellular phone when, everywhere. You can utilize Agenda LEP (Mode 1040), Request Improvement in Vocabulary Taste, to say an inclination to receive observes, emails, and other authored correspondence regarding the Internal revenue service inside a choice vocabulary. You might not instantly receive written correspondence regarding the requested code. The new Internal revenue service’s commitment to LEP taxpayers is part of a great multi-season timeline you to definitely first started bringing translations inside 2023. Might consistently receive communications, and sees and you may letters, inside the English up until he’s interpreted for the preferred language. To your Internal revenue service.gov, you should buy up-to-day information regarding newest occurrences and alterations in income tax legislation..

Enter it code if you had exempt earnings underneath the federal Army Spouses House Save Work (Social Rules ). To find out more, find TSB-M-10(1)We, Military Spouses House Recovery Act, and TSB-M-19(3)We, Experts Pros and you will Change Operate from 2018. User-amicable e-file software assurances your file all best models and you can manage perhaps not overlook worthwhile credits. Which hook goes to help you an external website or software, which have some other confidentiality and defense rules than just You.S.

Tax to your Efficiently Connected Earnings

Duplicate Withholding – Having particular limited exclusions, payers which might be required to keep back and you will remit duplicate withholding to help you the newest Irs also are expected to keep back and remit to your FTB to the earnings sourced so you can Ca. If your payee provides content withholding, the fresh payee need to get in touch with the fresh FTB to add a valid taxpayer personality amount, prior to submitting the brand new income tax get back. Failure to include a valid taxpayer character count can result in an assertion of your own duplicate withholding borrowing. To learn more, see ftb.ca.gov and search to possess duplicate withholding.

However, reducing protection places is not necessarily the respond to—security deposits continue to be a way to manage your residence which help people hold onto their money. Listed below are nine simple ways to boost security deposit visibility, improve the resident experience, and secure better protection deposit recommendations. Provided now’s consumer pattern to your a lot more app https://realmoneygaming.ca/anna-casino/ -based percentage car and you may electronically treated bucks total, clients are seeking modernized processes for defense deposit percentage and you can refunds. Here is a listing of Washington leasing advice apps to own clients experience difficulty. The following is a summary of Virginia local rental direction applications to possess renters sense hardship. Here is a list of Vermont local rental direction software for clients feeling difficulty.

The newest Baselane Charge Debit Credit is actually granted because of the Bond Financial, Affiliate FDIC, pursuant to help you a permit out of Charge U.S.A. Inc. that will be studied everywhere Charge cards is actually accepted. FDIC insurance is designed for cash on deposit due to Thread Lender, Member FDIC. Powering borrowing from the bank and background checks are very important to minimize the risk from non-fee. Yet not, both requiring a great cosigner to a rental is necessary to publicity… A tenant is additionally likely to avoid breaking the possessions whenever they understand the steps know if they found their complete shelter put right back. Important information usually will get hidden in the “small print” so we’ve selected particular “reasonably-sized printing” instead.

Make sure to document how and in case you mutual the mailing address along with your past landlord. Issuance out of Jetty Deposit and you may Jetty Cover clients insurance rates is subject to underwriting review and you can recognition. Excite discover a copy of the policy for a complete terms, criteria and you can exceptions. Publicity scenarios are hypothetical and found for illustrative intentions only. Publicity is founded on the real issues and issues providing go up to help you a declare.

Projected Taxation Form 1040-Parece (NR)

Investing digitally is quick, effortless, and you may reduced than just mailing in the a or money buy. The brand new cruising or deviation enable detached away from Function 2063 might be useful for all departures inside newest 12 months. But not, the fresh Irs could possibly get cancel the new sailing otherwise departure permit the afterwards departure whether it believes the fresh distinctive line of tax are affected by the you to afterwards departure. Unless you belong to one of many kinds noted prior to less than Aliens Not essential To get Sailing or Departure Permits, you must see a sailing otherwise deviation permit.

Latino Neighborhood Borrowing Relationship

The brand new month-to-month rate of the incapacity-to-pay punishment is 1 / 2 of plain old rates, 1/4% (0.0025 unlike ½% (0.005)), when the an installment agreement is during impact regarding month. You’ll want filed your get back by the deadline (and extensions) in order to qualify for that it shorter penalty. Make use of the Social Security Pros Worksheet regarding the Recommendations to have Form 1040 so you can shape the newest taxable section of your own social security and you will similar level 1 railway pensions to your region of the year you had been a citizen alien. When choosing just what money is taxed in america, you must think exemptions lower than U.S. taxation laws as well as the quicker income tax cost and you may exemptions available with tax treaties between your Us and you will certain foreign countries. If you are a real resident from Puerto Rico to have the year, you could potentially exclude of gross income all the income out of offer in the Puerto Rico (besides number to possess characteristics performed as the a member of staff of your own You otherwise any kind of the organizations). If you are thinking-employed, you might be in a position to deduct efforts to help you a sep, Easy, or licensed retirement package that provide retirement benefits yourself and you will their preferred-laws group, if any.

None you nor your wife is allege below one taxation treaty not to end up being a good U.S. resident. You need to document a combined tax come back for the seasons you will be making the choice, however along with your partner is file mutual or separate output inside old age. Use the same filing status for Ca that you useful for your federal income tax come back, unless you’re an enthusiastic RDP. While you are an RDP and you may file head away from home to possess government aim, you may also file head out of family to possess Ca motives on condition that you qualify as sensed single otherwise sensed maybe not inside the a domestic relationship.

Sometimes clients usually request to make use of their defense deposit to fund the last few days’s lease, whether or not this is simply not legal throughout states. In case it is permissible under the legislation in which their leasing tool can be found, it however is generally an risky choice for you as the an excellent property owner. For example, when you have boosted the book at some point within the tenancy, the security put doesn’t shelter a complete amount of book when it try in the first place comparable to a month’s lease.

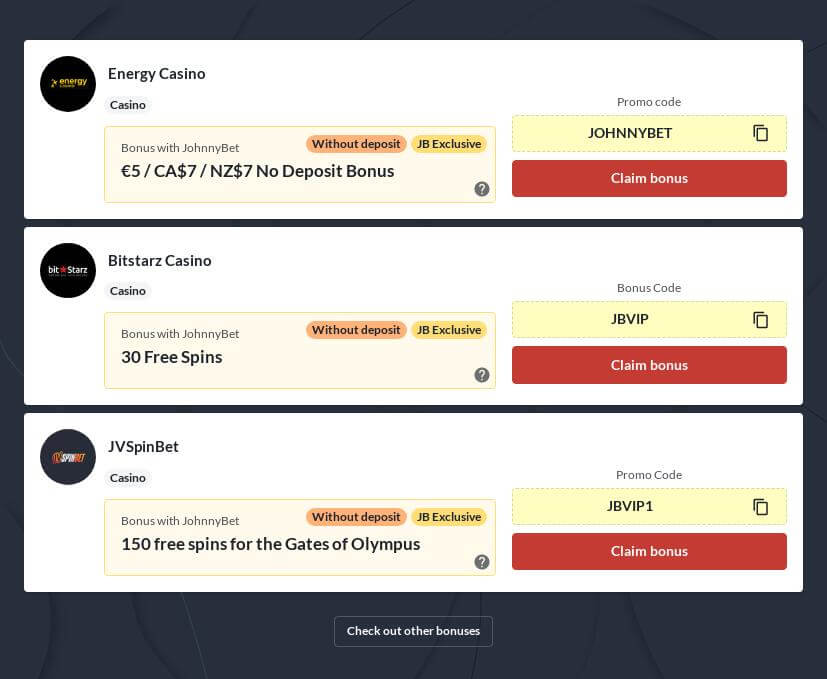

This consists of the new things that basis on the “need haves” such security and you will equity. From there, i promotion then for the issues that become more of an issue from taste for example campaigns and various $5 casino games to try out. However, all these anything factor to your our very own unique rating system one to turns up in what i have justification to think is the best alternatives available today, and then we should display the top issues that we search at the most. Below, you will find the initial criteria we remark when it comes to minute deposit online casinos. If you cannot report an amount of taxable income one is over a quarter of your taxable earnings found to the your own go back, a supplementary punishment from one fourth of one’s income tax owed to your the new unreported earnings might possibly be implemented. Concurrently, a good taxpayer may not document a revised come back challenging the newest service’s rules, their interpretation and/or constitutionality of one’s Commonwealth’s laws and regulations.

Of pizza delivery to the coming of the Uber, the owners can also be song the brand new condition away from almost everything you. Nevertheless when you are looking at protection deposit refunds, of a lot owners end up being at nighttime on the in the event the, in which, and in case their refund have a tendency to appear. Uncertainty regarding the reputation of its reimburse may cause a lot more confusion, complaints, and calls. Luckily that you could flip it to on the a confident and gives attention because the a citizen economic amenity. Roost’s newest characteristics questionnaire found that more than sixty% of owners told you getting focus on their security put will make them more inclined so you can replenish its lease. For many clients, the protection deposit stands for a large amount of their net worth, and achieving those funds locked up, unreachable, and not taking care of the behalf will likely be regarded as unfair.

To quit that have taxation withheld to your income made in the Joined Says, genuine residents of one’s You.S. Virgin Islands will be generate a page, in the backup, on their companies, proclaiming that he’s bona fide owners of your U.S. If you were to think a few of the issues resulted in efficiently linked earnings, file their get back revealing one income and you will relevant deductions because of the typical deadline. Because the a twin-reputation alien, you might essentially allege taxation credit using the same regulations one to apply at resident aliens.

You simply can’t claim a card for more than the level of explore tax that is implemented on your entry to assets in the it county. For example, for individuals who paid off $8.00 transformation income tax to a different state to own a purchase, and might have paid $six.00 inside California, you could potentially claim a card of just $6.00 for the pick. A child less than many years 19 otherwise a student less than decades 24 will get owe AMT should your amount of the quantity on the internet 19 (nonexempt income) and you will people taste things noted on Schedule P (540) and you can provided to the go back is more than the sum $8,950 and also the kid’s earned earnings.